Understanding New-Age Communication Preferences of Channel Partners

Jul 20, 2024

In the digital age, channel partners from all profiles, sectors, and regions have adopted the most up-to-date means of communication. Not only do they have several communication channels, but they also have a clear preference for how and when they want to receive communication from their brands.

Scroll Down

To identify the communication preferences of channel partners, in terms of modes, timing, and frequency, BI WORLDWIDE and KANTAR, conducted a first-of-its-kind research, involving interactions with 700+ distributors, retailers, and influencers across 6 prominent industries in India. The inquiry uncovered interesting insights, which can help trade marketing brands devise the right channel partner communication strategy, ensuring it drives measurable business results.

“In today’s digital world, communication must be an essential part of strategy setting, and not an afterthought. To drive synergy with channel partners, brands need to craft the right business narrative and take this narrative to channel partners squarely through their preferred communication mediums. BI WORLDWIDE’s pioneering research underscores the pivotal role digital communication plays in empowering brands to nurture strong channel partnerships and achieve their high-stakes business KPIs, such as tapping into new markets, increasing sales, enhancing brand advocacy and more.”

Ashish Kumar, Marketing Director, BI WORLDWIDE India

What Channel Partners Prefer – Voice, Digital, Social Media, Mobile Apps, and More

If you think that messaging apps and social media are only for channel partners in their youth or in urban areas, our study has some revelations for you.

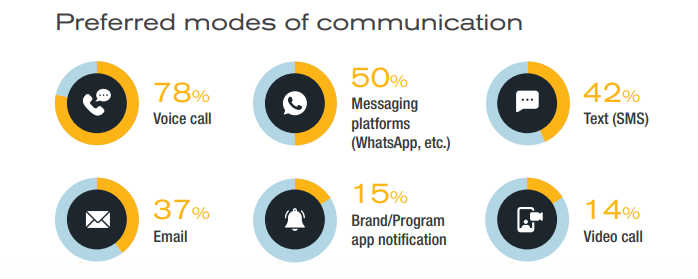

78% of channel partners prefer receiving communication from brands through voice calls. And a rather significant 50% prefer receiving it through app-based messaging platforms such as WhatsApp. Most importantly, the best time to talk with channel partners is between 3 to 5 pm. In fact, the onus is on the brands to devise an appropriate communication format after understanding the communication preferences of their partners.

Brands Need to Go Digital

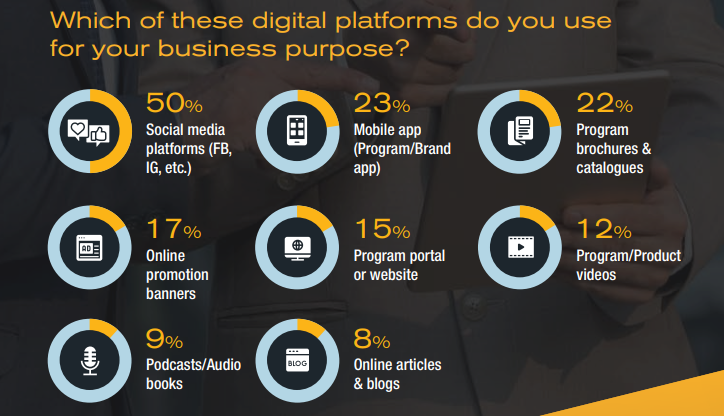

Channel partners across all industries prefer digital media over traditional media. Digital media not only includes social media and mobile applications, but also programme brochures & catalogues, online promotion banners, websites, product/programme videos, podcasts or audio books, and online articles & blogs.

Unsurprisingly, a clear preference for social media platforms is undisputed across all sectors.

Social media is an important space that channel partners are exploring. Half of the channel partners use social media platforms such as Facebook and Instagram for business purposes. Two out of three channel partners use mobile apps, programme brochures and catalogues each for the same purposes. For example, 56% of B2B channel partners use social media, compared to 46% of B2C. This means brands that are not present on social media platforms and mobile apps are missing half of their target audience.

The sectoral breakup of channel partners and their usage of social media shows that 61% of the channel partners in pharmaceuticals sector use social media platforms such as Facebook and Instagram, which is the highest. Channel partners from FMCG sector record the lowest level of use of digital media for business purposes. Only 43% of them use social media, and only 3% of them read/rely on online articles and blogs to learn about brands.

Digital Communication: The Secret Sauce to Building a Compelling Channel Partner Engagement Strategy

Brands need to evolve with time and embrace digital platforms when it comes to communicating effectively with their channel partner ecosystem. In the long run, it is this strategic digital communication that can help brands foster a sense of trust and collaboration with their channel partners, ultimately leading to business success.

BI WORLDWIDE and KANTAR’s unique research underlines that voice, messengers, and apps are the most significant mediums to consider while developing channel partners’ communication strategy. These new-age communication channels can positively impact business communication and empower brands to deliver meaningful experiences to their distributors, retailers, dealers, and influencers.

Download Whitepaper

The best way to get started is to get in touch.